By Jesse Colombo (This article is frequently updated)

Switzerland’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

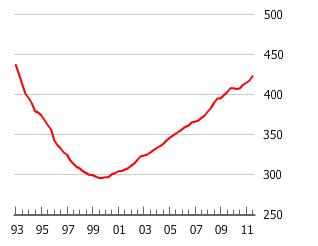

Chart Source: GlobalPropertyGuide.com

Global and EU economic turmoil have heightened Switzerland’s traditional economic safe-haven appeal, particularly due to the fact that Switzerland is not a part of the EU and has its own currency, the Swiss Franc. After suffering from a 1980s property bubble, Swiss property prices rose an average 42% since the year 2000, with prices doubling in some spots, for reasons similar to those of concurrent European housing booms. The median price for a house across Switzerland is now a California circa 2005-esque $850,000, $2.1 million in Zurich and an astronomical $2.55 million in Geneva. [1] Switzerland’s central bank (the Swiss National Bank), in an effort to stem the rapid EU-crisis induced rise in the Swiss Franc, cut interest rates to 0% and instituted a currency ceiling in the summer of 2011,  creating alarmingly similar monetary conditions to those that caused Switzerland’s 1980s property bubble. [2]

creating alarmingly similar monetary conditions to those that caused Switzerland’s 1980s property bubble. [2]

In response to rising Swiss real estate prices, UBS launched a Swiss real estate bubble index, which hit a 20-year high in February 2012 [3], while the Swiss National Bank Chairman Philipp Hildebrand warned that, “A rise in real-estate prices is among the greatest threats to Switzerland’s economy.” [4] Most worrisome is the warning of Janwillem Acket, chief economist for Julius Baer Group Ltd. (BAER), who claims that Switzerland could experience its own version of the subprime borrowing crisis, saying, “People who shouldn’t be borrowing are now seriously considering entering the housing market.” [5]

Swiss Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: