(This is the 2nd page of this report. Click here to read the first page.)

Introducing the "CCC Aches" Bubbles

As a reminder, "CCC Aches” is an acronym that I’ve developed to help people remember the most important economic bubbles of the post-Great Recession period, China, Commodities, Canada, Australia, College (U.S.), Healthcare (U.S.), Emerging markets and Social media. The expanding "CCC Aches" bubbles are responsible for creating an illusion of economic strength including what I call a "bubblecovery," a bubble-based economic recovery, similar to how the U.S. housing bubble led the economy out of the post-Dot-com bubble doldrums.

The Chinese Economic Bubble

While the U.S.-epicentered housing and banking meltdown dragged the rest of the world into the Global Financial Crisis, China’s expanding economic bubble pulled the world back from the brink of a near-depression. After China’s exports plunged in 2008, the Chinese government quickly scrambled together a massive $586 billion economic stimulus program that was primarily invested in public infrastructure projects, housing, rural development and the rebuilding of areas hit by the 2008 Sichuan earthquake. China’s stimulus plan was successful at staving-off a recession and social crisis – so successful that inflation, overheating and overbuilding quickly became a concern again as the newly printed stimulus money sloshed around the economy, creating very alarming distortions and speculative activity.

China’s fixed asset investment, which was already very high to begin with, has further exploded since the launch of the 2008 stimulus program, accounting for more than 90% of economic growth in 2009. Over 100 extremely ambitious infrastructure mega-projects are currently being undertaken. Chinese cement consumption and construction spending has soared to truly bubble-like proportions as scores of extravagant and massive government buildings are being built in outer China, roads are dug up and rebuilt just to generate economic activity and cities binge on debt to build jaw-dropping infrastructure projects at all costs.

A particularly strange and somewhat eery phenomenon has arose as a result of China’s building purely for the sake of creating economic growth – completely uninhabited “ghost cities,” such as Ordos in Inner Mongolia and many other empty full-size cities filled with apartment buildings and skyscrapers that can be seen in great detail via satellite imagery. Even the world’s largest mall, the New South China Mall, has been (link has an excellent video) 99% vacant since it opening in 2005 – malinvestment at its finest. There are now 70 billion sq. feet worth of buildings of all types under construction and enough new office space to give every person in China a 5×5 cubicle.

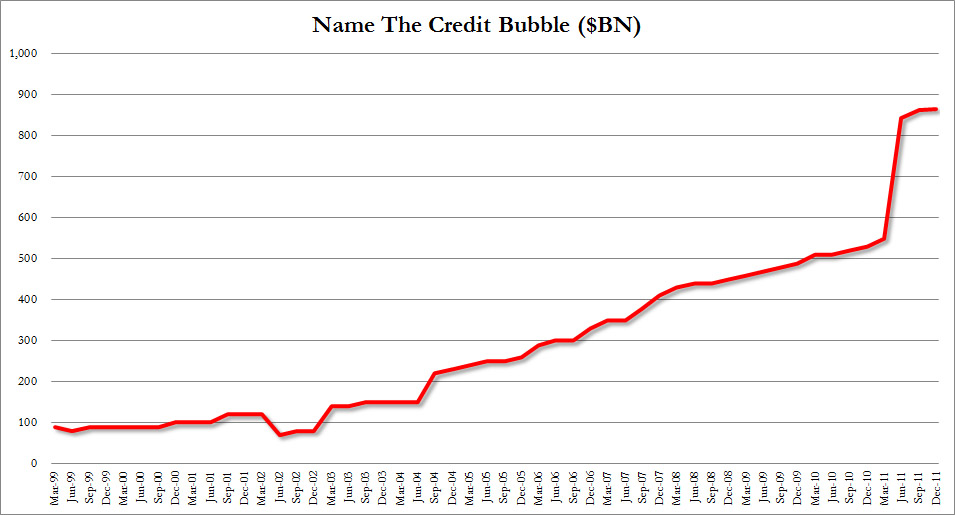

Economic bubbles and reckless credit booms go hand in hand and the China Bubble is no exception in this regard. A chart of Hong Kong banks’ exposure to Mainland Chinese debt displays the truly parabolic nature of China’s credit bubble that started in 2009. China’s local governments have financed their ridiculously extravagant construction projects via a$1.7 trillion “subprime” credit bubble, of which $540 billion is likely bad debt, according to Moody’s.

China’s blazingly fast economic growth coupled with an expanding credit bubble and fresh sloshing stimulus money created the perfect conditions for inflation, which has manifested in the form of soaring rents, food prices and wages. High inflation, negative real interest rates and limited investment options encouraged many Chinese to buy real estate to protect their savings from the ravages of inflation, helping to reinflate a housing bubble that first reared its ugly head 2008. Housing prices soared 140% higher nationwide from 2007 to 2011 with Beijing housing up 800% since 2003. Clearly having learned nothing from the disastrous U.S. housing bubble, real estate speculators or “flippers” have taken China by storm, buying “real estate as if they were buying vegetables,” such as the housewife who bought 10 properties within 30 minutes and the college student who flipped an astounding 680 flats.

China’s flurry of artificial economic activity since 2009 has created a commodities demand bubble, sending commodities prices soaring, and creating economic growth booms in natural resource rich countries all over the world, from Australia to Canada to many emerging market nations. China’s growth bubble has helped it and countries that are experiencing China-fueled commodities booms become a robust export markets for a wide variety of Western goods, from machinery and other capital goods to consumer products like Apple iPhones & iPads, greatly cushioning the Great Recession’s blow on Western economies. This is yet another reason why the recovery from the Great Recession is actually a “bubblecovery” rather than a sustainable growth boom.

China’s economic growth and thus the growth of commodities exporters such as Australia has slowed since mid-2011 due to intentional efforts by the Chinese government to reduce inflation. China’s slowdown does not necessarily mean that China’s bubble is over. On the contrary, China is now embarking on an upturn in its liquidity cycle as its central bank tries to stimulate the economy again. These upturns have typically resulted in surges in Chinese asset prices as well as global commodities prices. In addition, there are plans in the works to launch another economic stimulus program aimed at building public housing projects and boosting domestic consumption. There is a strong probability of a stock market bubble, coinciding with an overall emerging market stock bubble, if China’s stock market finds renewed favor with investors after years of tepid performance.

The combination a reflating Chinese economy and the ongoing U.S. “bubblecovery” may kick the global bubble boom into overdrive. More confident American consumers, many with new jobs in healthcare, education, natural resource production and social media/technology, will spend more, helping Chinese exports to recover. In addition, China’s brand new 5-year economic plan places a very strong emphasis on increasing consumer spending, which will be a boon for Western exports. A resurgence in the global commodities boom, with a strong focus on a global oil and gas shale drilling boom, may spark higher demand for Chinese steel products and thus Australian iron ore and coal. Higher oil prices will incentivize the extraction of China’s massive untapped 1,275 trillion cubic feet of natural gas reserves, creating a boom in its own right as well as a wave of business activity due to the conversion from coal and oil-based fuels to natural gas for use in everything from powerplants to trucks.

Another possible contributor to a future bubble boom is China’s liberalization of restrictions on foreign investors looking to invest in China as well as restrictions on its own citizens looking to invest abroad. The State Council, China’s cabinet, said it is considering giving permission to residents in the city of Wenzhou, an eastern city known for entrepreneurship, to invest abroad directly. Shanghai official plans to launch a pilot program that would allow some foreign hedge funds and others to raise yuan funds on the mainland for overseas investment. In the past, having too few investment options within China has resulted in too much money chasing domestic real estate and stocks, leading to bubbles and inflation. If Chinese investors are able to invest in foreign markets, it would alleviate some domestic inflationary pressures while providing fuel for a bubble boom in foreign markets.

Read more about the China Bubble

The Commodities Bubble

The rapid development and economic bubbles in China, India and other emerging markets during the past decade have caused commodities prices to soar to incredible new heights and has created a boom in natural resource exploration, production and exporting. The growth booms in Canada, Australia and most emerging market nations are strongly built on the back of the commodities bubble. When commodities prices plunged due to the 2008 Global Finance Crisis, natural resource-exporting nations were hit by a double-whammy of both reduced demand and prices of their exports, which threatened to throw them into a tailspin. China saved the day when it launched its $586 billion economic stimulus program in 2008, which was aimed at creating massive infrastructure megaprojects and the building of entire empty cities to create economic growth, Keynesian-style. The China-led surge in commodities demand and prices helped reinvigorate the economies of natural resource-exporting nations and has been a powerful contributing force to the global recovery from the Great Recession. The “bubblecoveries” in China and natural resource-based economies has abetted the American recovery by creating a robust export market for goods produced by U.S. multinational corporations, which earn the majority of their revenues abroad.

The combination of the China-led commodities boom and stimulative actions by global central banks, including the U.S. Federal Reserve, has created a bubble boom in U.S. agricultural regions as food prices rise to lofty new heights. U.S. farm income hit an all-time high of $100 billion in 2011, up an incredible 28 percent from 2010. U.S. farmland prices are up 17% in 2011 alone, on top of an explosion during the past decade, sparking fears of a farmland bubble. (1 ,2)

This chart of Iowa farmland prices displays the farmland bubble very nicely:

Soaring agricultural incomes and bubbling farmland prices have caused the Rural Mainstreet Index, a gauge of economic health in American rural regions, to recently hit its highest level since June of 2007, as flush farmers are snapping up brand new pickup trucks, $250,000 tractors and $500,000 combines – and paying with cash. (1, 2) The rural American bubble economy is contributing to the overall post-2009 “bubblecovery” as companies such as, but not limited to, GM, Ford and John Deere are seeing increased sales paid for with “bubble money.”

America’s agriculture bubble boom is paralleled by a boom in mining and oil & gas extraction, which was by far the fastest growing jobs sector in 2011, increasing by 12.4%. Furthermore, 9% of all new jobs created in 2011 were directly and indirectly related to the oil & gas sector, spurred in a large part by the Bakken oil shale boom in North Dakota and the gas shale “fracking” booms in the Marcellus shale region of Ohio and Pennsylvania as well as similar booms in Texas, Colorado, Wyoming and Louisiana. In addition to creating high-paying energy exploration and extraction jobs throughout the country, the boom is minting scores of overnight millionaires or “shalionaires” as property owners in gas shale regions have recently started earning lucrative mineral rights royalties that can total up to $60,000 per month. (1, 2, 3) Like the beneficiaries of the agriculture boom, winners of the oil & gas boom are spending their newfound earnings on pricey pickup trucks and state of the art farm equipment (the farmers who earn gas royalties), boosting the fortunes of U.S. automakers and farm equipment manufacturers as well as the U.S. economy at large. The combination of iron and nickel ore mines being reopened in northern Michigan, the resurgence of U.S. automakers and the Marcellus natural gas boom is creating an economic renaissance in the Midwest “rust-belt” region, which was recently one of the more depressed areas of the U.S. but is now recovering from the Great Recession faster than the rest of the country. Appalachia is another region that is poised to benefit from the nearby shale gas bonanza as the newly reinvigorated U.S. chemical industry is building chemical plants to take advantage of the cheapest natural gas supplies in the world, creating many much-needed blue collar jobs in the process. (1, 2, 3 )

The commodities boom will play an absolutely crucial role in the coming bubble boom. The next expansion phase of the commodities boom will likely be kicked-off by a continued recovery of the U.S. economy and the upturn in China’s liquidity cycle as its central bank tries to stimulate the economy again. When U.S. money velocity and credit growth pick up as the economy thaws, commodities prices will rise due to the expansion of the money supply and increased demand for raw materials. The record short position in the euro currency futures markets (as discussed earlier) may be unwound if the benign economic conditions and thawing continues, sending the euro higher and the U.S. dollar lower, boosting commodities prices in the process. Precious metals would be strong performers in this scenario as they usually are during times of rapid money supply expansion, such as the 2002 to 2008 credit boom period. Warming and eventually bubbling economies and higher commodities prices will send the global commodities exploration and production boom into overdrive, sparking the acceleration of the bubble booms in natural resource-heavy economies such as Canada, Australia and many emerging market nations. A very significant amount of future lending and investment activity will likely be focused on natural resource-related projects, causing global productive capacity to soar, mitigating a portion of the commodities-price inflation.

The aforementioned commodities-bullish scenario would result in elevated oil prices, which will cause some initial discomfort but may end up being the precise catalyst that is needed to launch a new two-part boom and eventual bubble that may end up being the “star” of the entire future bubble boom show: 1) the oil and gas shale boom going global – and – 2)a global mass-conversion to natural gas as a fuel source.

High oil prices have incentivized the development of new oil drilling technologies, such as horizontal drilling and hydraulic fracturing or “fracking,” that are creating oil booms all across the United States, while unlocking a potential 2 trillion barrels of domestic U.S. oil. South America could also have up to 2 trillion barrels of oil, while Canada may have 2.4 trillion barrels, compared to just 1.2 trillion in the Middle East and north Africa. A recently discovered oil field under the South China Sea is estimated to hold enough oil and gas to be “the next Saudi Arabia.”

Horizontal drilling and hydraulic fracturing have led to astounding advances in natural gas production, making accessible as much as 500 trillion cubic feet of natural gas in the Marcellus shale formation in West Virginia, Ohio, Pennsylvania, and New York, now the largest producing natural gas field in the world. New York State has placed a complete moratorium on fracking since 2008 but if the moratorium is lifted, it would spur $11.4 billion in economic output and create 15,000-90,000 jobs, depending on the adopted regulatory regime as well as providing a cheap domestic source of fuel for the heavily populated New York metro region. In addition to the Marcellus shale formation, but still in the very early stages of exploration, is the Utica shale formation, which lies just underneath the Marcellus formation and is estimated to contain 5 billion barrels of recoverable light sweet oil and 15 trillion cubic feet of natural gas. The Eagle Ford shale formation was discovered in Texas in 2008 and is estimated to have 20.81 trillion cubic feet of natural gas and 3.351 billion barrels of oil, while the Haynesville shale formation in Eastern Texas and Louisiana is estimated to contain roughly 60 trillion cubic feet of recoverable natural gas reserves. These are just a few of the known natural gas-containing formations in the United States – there may be more natural gas formations that may be found as the boom further develops. A conceivable jackpot of new gas shale fields will be discovered as the new drilling technologies spread globally, such as Royal Dutch Shell’s recent discovery in China, part of the country’s staggering 1,275 trillion cubic feet of untapped shale gas resources – by far the largest in the world. Poland recently announced that it has reserves of approximately 1 trillion cubic meters of natural gas as well. The global oil and gas shale boom will certainly be one of the most powerful drivers of economic growth and job creation in the near future as well as one of the most important arenas for future lending and investment activity and is a very strong candidate for ultimately developing into a full-blown economic bubble (including Dot-com bubble-like action in related stocks), which would likely coincide with the overall “CCC Aches” bubble boom.

While global shale gas production is only in its very early stages, the record supply of new gas is already causing U.S. gas prices to plunge to multiyear lows, down 25% in 2011 and 33% in the just the first few months of 2012:

Natural gas’ new low price of just above $2 per 1,000 cubic feet may soon spur a wave of conversions from coal and petroleum fuels to natural gas for economic reasons alone, not to mention its other numerous benefits. According to billionaire energy entrepreneur T. Boone Pickens:

We now have the cheapest energy in the world. Natural gas here costs $2.40. Beijing, it’s $16. Mid-East, $15. Europe, $13. Oil, we’re at $100 a barrel where the world market price is $115. So we’ve got cheap energy. Consequently, if we had good leadership in Washington, we could rebuild our economy on the back of cheap energy. So it’s an exciting time for this country.

Trucks are switching over right now to natural gas, because it’s a dollar and fifty cents per gallon cheaper. Look, in 1972 when diesel was so cheap, they started switching away from gasoline to diesel. Same circumstances you have now. And it took five years to do it.

The “economics of natural gas fuels will remain very attractive almost indefinitely,” said Pavel Molchanov, an analyst at Raymond James & Associates Inc. “The excess supply of natural gas is so persistent and so structural that it really will take a very, very long time before we have to worry about prices getting to levels where they are on par with oils.”

According to JMP Securities LLC’s Shawn Severson, “Using natural gas could cut fuel costs by more than $20,000 for a truck traveling a typical long-haul distance of 100,000 miles (161,000 kilometers) a year.” Though a truck operating on natural gas costs about $40,000 more than the $110,000 price tag for a diesel-powered equivalent, Severson says that cheaper fuel costs, nonetheless, “will force adoption.” He calculated that it will take about two years for a long-haul truck to recoup the additional cost of the technology. There is a strong likelihood that proposed government subsidies will defray the higher cost of natural gas vehicles as well.

Trucking companies that are converting to natural gas are already reaping the benefits. “Nobody can beat us on rates right now if we have the gas component in place,” said Dillon Transport Inc. founder Jeff Dillon, who started the business 32 years ago with one truck and now owns 350. “We’ve probably got about a three-year window to have the advantage.” Ryder, United Parcel Service Inc., Mohawk Industries Inc., Dean Foods Co., and Staples Inc. currently count natural gas-powered trucks among their fleet, while Swift, the largest truckload carrier in North America, is dipping its toes into the water, with their Chairman & CEO Jerry Moyes saying, “We’ve been testing it for about a year, and we like what we see. We are still in the experimental stage, but it has great promise, it is gaining momentum, and we are cheering it on.”

T. Boone Pickens talks about how converting the national truck fleet to natural gas will benefit the U.S. economy:

So now, you’ve got eight million eighteen-wheelers switching over to natural gas over the next five to seven years. When that happens, that’s equivalent to three million barrels of oil per day. That’s a lot. Right now, we import five million barrels of oil per day from OPEC. So theoretically, you could knock out 60 percent of your OPEC imports with eighteen-wheelers alone.

Oil accounts for two-thirds of the U.S. trade deficit, so harnessing our newfound abundant natural gas supplies is a win-win proposition as it reduces our foreign energy dependence and the amount of American money sent to hostile and volatile regions of the world, while recycling the money back into the U.S. economy. Another deal sweetener is the fact that compressed natural gas usage can result in 30 to 40 percent less greenhouse gas emissions, according to the U.S. Environmental Protection Agency.

Aside from high oil prices, recent U.S. government support of natural gas as an alternative fuel source may be another catalyst needed to launch the natural gas conversion boom. President Obama gave a speech on March 7th, 2012 in which he proposed a federal tax credit designed to encourage the trucking industry to move toward natural-gas and electric vehicles by helping underwrite their higher acquisition costs. Obama said that his administration would work to create the tax credit equal to 50% of the additional costs incurred by companies that purchase the alternative-fueled vehicles. He proposed keeping the credit in place for five years in order to spur acceptance of the new models. Obama also proposed a $1 billion pilot project to encourage communities to speed the regulatory process for companies that seek to install fueling stations for the alternative-fuel vehicles and offer incentives to get local companies to invest in lower-emissions vehicles.

There are currently about 110,000 natural gas vehicles in the U.S. and between 1,000 to 1,500 natural gas fueling stations and U.S. natural gas infrastructure development may significantly accelerate as the price differential between petroleum and natural gas stays wide and even widens and more automakers start to offer natural gas vehicles. Chesapeake Energy, a leader in the natural gas industry, and General Electric have partnered to bring natural-gas fueling to gas stations and convenience stores, with the intention on building 250 natural-gas compression stations called "CNG in a Box" by 2015. The "box" is actually an on-site facility for compressing natural gas coming from a pipeline at a refilling station or industrial location. Chesapeake Energy is investing $1 billion in natural gas infrastructure and fueling stations over the next decade and is giving money to Clean Energy Fuels Corporation to construct 150 natural gas fueling stations along interstate highways. In addition, Honda Motor Co., the only automaker selling compressed natural gas-powered cars to U.S. drivers, intends to have some of its dealers to install pumps to sell the fuel as it seeks to double sales of CNG vehicles. There is also a very strong chance that Big Oil companies may simply offer CNG fuel pumps alongside conventional fuels in its gas stations as Chevron currently does in Pakistan and Royal Dutch Shell does in Canada.

High-profile investors are foraying into the natural gas field as T. Boone Pickens led a group of investors in investing $150 million in Clean Energy Fuels Corporation, while George Soros’s investment funds have invested about $122 million into Westport Innovations, a company that converts diesel engines to be fueled by natural gas. Westport has teamed with Cummins to produce midrange natural gas engines, such as those that power transit buses. Peterbilt has led the way among large-truck manufacturers by teaming with Cummins Westport and Westport HD to provide a family of alternative-fuel vehicles. In July 2011, Westport formed an agreement with General Motors to foster the development of new engine components to power the Detroit company’s light vehicles and position it in an alternative power train market beyond the one currently served by the plug-in electric Chevrolet Volt. In September 2011, Westport Innovations and Royal Dutch Shell formed a co-marketing program intended to provide an integrated solution to the needs of operators of natural gas vehicles, especially trucks.

As the shale gas boom goes global, there may be a mass conversion to natural gas as a fuel source, not just for transportation, but for residential and commercial heating and power generation. The building of natural gas infrastructure and the trend of converting away from petroleum fuels to natural gas has the potential to generate a significant amount of economic activity and jobs and is likely to be a strong focal point for future lending and investment activity. In addition, the natural gas boom would provide a strong incentive for many unemployed and underemployed blue collar workers to retrain (likely at hefty tuition rates and financed by student loans) at vocational schools for new careers related to the boom, reducing the unemployment rate and contributing to the education bubble. While the shale gas boom and natural gas conversion trend may not be experiencing a bubble yet (though it was spurred by the overall commodities bubble), there is a very strong chance that it, like many disruptive innovations throughout history, may develop into the next major bubble if an overall bubble boom materializes in the future.

Read more about the Commodities Bubble

The Canadian Economic Bubble

As far as post-2008 global growth engines, Canada’s booming $1.58 trillion economy certainly fits the bill. Canada’s economy barreled through the Great Recession as if it was a non-event, bolstered by a ballooning housing and household debt bubble, along with a commodities export boom, which is part of the commodities bubble. Canada has been a prime beneficiary of international “hot-money” that has clamored for investments outside of the U.S. and ailing European nations since 2008, helping to pump the Canadian housing bubble to a size that is now nearly 40% larger than America’s bubble at its 2005 peak. Like Americans during their housing bubble, Canadians are now binging on credit like there’s no tomorrow.

Canada’s bubble-induced economic strength has helped to cushion the Great Recession’s blow to the U.S. economy as the two nations have one of the most extensive economic relationships in the world, with Canada being the U.S.’s largest export market, at nearly 20% of exports. U.S. exports to Canada have soared since 2009, helping to contribute to the U.S.’s bubble-based economic recovery.

If the world undergoes a bubble boom in the next few years, Canada will be a prime player due to its abundant natural resources (especially oil and gas), perceived safe-haven status and high-yielding investments that will likely attract significant amounts of the world’s recently-minted oceans of cash as global risk appetites increase. As Canada’s economy bubbles up to incredible new heights, the U.S. economy will reap some of the (temporary) benefits, further reinforcing the U.S. “bubblecovery.”

Read more about the Canada Bubble & Canadian Housing Bubble

The Australian Economic Bubble

Australia’s $917 billion economy is experiencing a bubble that is very similar to Canada’s bubble. Australia never experienced a recession during the Great Recession period because its economy continued to grow thanks to their runaway housing and household debt bubble, along with a China-bubble driven commodities export boom, which is part of the overall commodities bubble. Like Canada, Australia has been a prime beneficiary of international “hot-money” that has poured into investments outside of the U.S. and ailing European nations since 2008, helping the Australian housing bubble to grow larger than America’s housing bubble was in its heyday, accompanied by a huge boom in mortgage debt. Just like Americans in 2005, Australians are engaging in a debt-fueled spending binge.

Natural resource-rich Australia has benefitted from China’s soaring demand for iron ore and coal to make steel for its overly-aggressive development, including its numerous empty cities, empty apartment buildings and extravagant megaprojects. Australia’s mining boom has resulted in peculiarities such as young high-school dropouts who are earning $200,000 per year as mine workers and a plan to hire an incredible one third of Ireland’s unemployed due to the Western Australia mining region’s desperate need for immigrant workers. Australia is shaping up to be a major player in the nascent global natural gas boom thanks to a LNG investment project boom, with investments surging from $10 billion in 2010 to an estimated $30 billion in 2015 on existing projects alone, including the $40 billion Gorgon LNG project. In the next six years to 2018, Australian natural gas export volumes are expected to quadruple to 80 million tonnes a year.

Australia would be at the forefront of a coming bubble boom, benefiting from a Chinese growth rebound as their monetary policy is loosened, booming commodities prices and as a high-yield investment destination that will attract large quantities of the world’s idle cash, sending Australian investment asset prices to previously unimaginable levels.

Read more about the Australia Bubble & Australian Housing Bubble

The U.S. College & Education Bubble

While most people are aware of the soaring cost of higher education in the U.S., few are aware that the higher education industry is currently experiencing a massive economic bubble that has strongly contributed to U.S. economic growth and job creation throughout the Great Recession. Higher education revenues are soaring thanks to a 439% increase in tuition since 1982, a rise in cost that is much greater than the U.S. housing bubble (housing prices rose 4x, while college tuition has soared by over 10x), far outpacing the overall rate of inflation. The higher education industry’s growth boom is fueled by a student loan bubble that grew 511% since 1999 to $1 trillion (surpassing total credit card debt for the first time), with today’s average student graduating with 50% more student debt than graduates in 2001.

The chart below shows the truly parabolic trajectory of the student loan bubble in recent quarters:

Chart Source: ZeroHedge

The exploding student loan bubble is causing non-revolving credit statistics to experience record jumps in recent months (including a white-hot 31.9% y-o-y increase in November 2011) and many of the same lending mistakes made during the subprime bubble are being made again as lenders have pushed student loans on people who can’t afford them.

The ballooning student loan bubble is funding a higher education construction boom that is creating jobs and bolstering national economic growth even as other traditional drivers of economic growth have languished or disappeared altogether. Higher education construction spending has more than doubled in the past decade as colleges build outrageously opulent mega-million dollar vanity projects, all fueled by a colossal multilayer debt-binge (1, 2). As an example of the scale of the construction projects, Ohio State spent a lofty $243.8 million on 1,266 construction projects in 2010 and Tarant County College of Fort Worth, TX built a $192 million facility, paying more than three times what it should have cost (“Who cares if we overpay? It’s only the students’ money!”). As far as the most infuriating of the frivolous higher education construction projects, sports stadiums clearly take the cake, from UC Berkeley’s $321 million football stadium upgrade (that’s being built during the university’s worst budget crisis in history) to University of North Texas’ new $79 million football stadium .

Like healthcare in the U.S., education was one of the only sectors that added jobs through the Great Recession and was the third highest industry sector for employment growth in 2011, responsible for five percent of jobs created that year. Higher education careers pay very well and are becoming even more lucrative thanks to the merciless tuition hikes and the student debt bubble. As a reasonably typical example, the University System of Georgia saw a 30 percent jump in six-figure salary staffers between 2007-2010 and almost 50% increase in those earning over $200,000, while there are a soaring number of university presidents earning multimillion dollar salaries across the nation. (1, 2)

The education bubble is likely to continue as long as students continue to enroll in college at record rates (1, 2) due to the latest faddish delusion that “everybody should have a college degree,” which is similar to the “everybody should own a home” delusion that fueled the U.S. housing bubble. The education bubble’s contribution to a potential bubble boom is twofold: economic growth (due to continued hiring, soaring compensation and the construction boom) and a reduction in the unemployment rate as more people stay longer in school and head back for retraining (despite the fact that this retraining is of dubious value). An incredible number of Americans are essentially “hiding out” in school and are not counted as unemployed and this is an important element in creating the illusion of an economic recovery and declining unemployment rate. There are now — for the first time in three decades — more young women in school than in the work force, while middle-aged people are heading back to school in droves, increasing their student debt burden by an incredible 47% in just the past three years.

If the “CCC Aches” bubble boom heats up, many more unemployed and underemployed people will head back to school (further reducing the unemployment rate) to retrain for jobs related to the growing bubbles, particularly in healthcare, social media/technology and natural resources fields. Educational institutions across the board will likely hike tuition rates very aggressively using the economic recovery as a convenient excuse, resulting in a surge in revenues and profits. The retraining boom/bubble itself will create much more economic activity, business opportunities and new jobs, as bubbles typically do. A future lending boom will likely be focused on these areas. For-profit education companies, online colleges and vocational schools will play a large role in a future expansion of the education bubble. Even though the education bubble is setting the economy up for an epic crisis in the end, it is one of the primary growth engines of the U.S. economy at the moment and will play a crucial role in the coming bubble boom.

Read more about the U.S. College Bubble

The U.S. Healthcare Bubble

Perhaps the greatest reason why America merely experienced a Great Recession instead of a full-blown depression is that the U.S. has a $2.6 trillion bubble economy-within-an-economy that has continued to relentlessly expand and create large numbers of jobs and economic activity. The U.S. healthcare industry, a sub-economy that is larger than the UK’s entire economy, has become the latest economic bubble and domestic economic growth engine to replace the U.S.’s former growth engine, the finance and real estate bubble. Just how the housing bubble pulled the U.S. out of its economic slump and “jobless recovery” in 2004, with everybody from economists to business leaders to politicians credulously cheering on the housing-related activity, the U.S. healthcare bubble’s unsustainable expansion and resultant contribution to national economic growth and recovery has garnered many cheerleaders and few critics among a public so desperate to embrace any glimmer of economic hope.

Similar to the housing bubble, the U.S. healthcare industry’s growth is fueled by a Ponzi debt finance scheme and a product that is exploding in price from already high levels. Health insurance costs have soared 9% in 2011 alone and are expected to increase 5.4% in 2012, after rising three times faster than wages in the past decade. During this time, struggling small businesses were walloped with a 180% rate hike. Individual rate hikes by health insurance companies have become astoundingly audacious, such as Anthem Blue Cross of California’s 68% premium increase in 2009 and 39% in 2010, despite being in the worst recession since the Great Depression. As long-term care insurance jumps by up to 40% in 2011 and brand name drug prices rise even faster than medical inflation, the past decade’s doubling of hearing aid prices has some experts asking if there is a hearing aid price bubble! Healthcare spending as a share of the U.S. economy reached an all-time high of 18.2 percent in 2011, an incredible threefold increase since 1960. The sad fact is that Americans spend twice as much on healthcare compared to other developed countries, but get lower quality care and less efficiency. A perfect example of this is how an appendectomy costs $28,000 in the U.S. and only $3,000 in Germany, while an MRI costs $1,080 in the U.S. and a mere $280 in France.

The abnormally high and ballooning cost of American healthcare flows straight to the bottom-lines of the various players of the healthcare industry. A study from Columbia University shows that U.S. doctors’ exorbitant pay is one of the primary factors in the high cost of American healthcare. American doctors are paid around 5 times more than their average patient, a figure that is a shocking 3 times higher than in most other countries. Despite the near-Depression of the past several years, health insurance companies are turning record profits thanks to their brazen rate hikes and customers who put off care due to cost. A recent survey shows that healthcare executives are the highest earning CEOs, with the top executives at the nation’s five largest for-profit health insurance companies banking nearly $200 million in 2009. In 2009 alone, UnitedHealth CEO Stephen Hemsley took home a staggering $102 million! Health insurance companies are eager to blame everybody else when they hike their rates, when their soaring executive pay is one of the primary culprits in the rising cost of healthcare. Hospital profits have skyrocketed in recent years as they use their “local monopoly power to overcharge insurers and patients.” There certainly hasn’t been a recession in state hospital CEO pay as their multimillion dollar salaries have so-far been immune to state budget cuts. Excessive non-profit CEO salaries are creating an outrage, while the heads of the nation’s largest children’s hospitals siphon robber baron-like payouts.

In order to further tap into the seemingly boundless money tree that is the expanding U.S. healthcare bubble, hospital construction has been booming (1, 2, 3) as concern arises that children’s hospitals are overspending on extravagant construction projects. A recent study showed that the current medical building boom is increasing Americans’ health care costs and has been fueled by the borrowing of $144 billion through public bond issues (from 2008 to Nov 2011). An excellent animated short film entertainingly summarizes the medical building boom, how it is encouraged by political leaders for job creation purposes and why it will lead to a debt crisis. In San-Francisco, hospitals have recently become the new No. 1 industry and employ nearly one-fifth of the city’s workforce. The hospital building boom will only create excess capacity according to a Pittsburgh Tribune-Review report: “Though the number of hospital beds in the United States has dropped by 250,000 since 1990, the occupancy rate remains steady at nearly 70 percent, showing a general lack of need for more bed space.” The hospital sector is overbuilding and overexpanding, behavior that is typical during bubbles. The medical building boom shares many parallels with the higher education bubble’s construction boom and both are significant contributors to economic growth since the Great Recession.

Now that news of oversized healthcare profits and salaries have entered the public psyche, a healthcare jobs gold-rush is officially on. Thanks to the healthcare bubble’s continued expansion during the Great Recession, healthcare has been one of the few industries to add jobs (nearly 1 million jobs), greatly softening the recession’s blow. Of the 1.64 million net jobs created in the U.S. in 2011, a stout 315,000, or nearly one-fifth, were in the healthcare field and the first few monthly job reports of 2012 show the same trend as 2011. As the much of rest of the economy continues to downsize, healthcare’s share of employment recently hit an all-time high as signs of a healthcare employment bubble have become apparent.

There are signs that health information technology is likely in a bubble at the same time that it has officially become the “hottest” job for college graduates. It is not surprising to see a bubble appear in this area as both technology and healthcare are experiencing bubbles in their own right; the healthcare IT bubble can be considered a hybrid bubble. While healthcare IT startups are being churned out left and right by the startup incubator bubble, the CEO of Medivo, one of the “hot” healthcare IT startups, recently marveled at the incredible amount of investor money flowing into healthcare startups .

The healthcare bubble will likely play a very strong role if a bubble boom materializes in the future. The bubble’s mania phase will kick off when the healthcare industry dramatically hikes its rates using the economic recovery as a convenient excuse, resulting in a surge in revenues and profits. At the same time, healthcare stocks will likely soar as still-nervous investors choose to redeploy their investment capital first in “safe” industries like healthcare, which have performed remarkably during even during the worst of the Great Recession.

The Dow Jones U.S. Healthcare Index recently broke out above an important technical resistance level, indicating a strong probability of more gains ahead:

A boom in healthcare stocks and their valuations will create even more incentive for entrepreneurs and VCs to launch healthcare startups for the purpose of IPOing and taking advantage of the mania for all healthcare-related investments. The strong demand for these investments will likely incentivize the healthcare industry to raise large amounts capital to pursue even more aggressive hiring and technology acquisition plans (from tablet devices to multimillion dollar scanners and surgical robots) and increasingly extravagant construction projects, creating more jobs and economic activity. A very significant amount of future business lending activity will be focused on the healthcare arena. In addition, when unemployed and underemployed people see the bonanza of high-paying job opportunities created by the U.S. healthcare bubble, a very large number will head back to school (paid for by student loans, of course) for retraining in healthcare-related disciplines, causing the education bubble to experience an explosion in profits and a mania phase of its own.

Read more about the U.S. Healthcare Bubble

The Emerging Markets Bubble

Amid the excitement over the rise of China, investors and economic commentators have been eagerly scouring the world for “The Next China” – or at least the next country to supply the raw materials that China needs for its boom (and construction of empty cities!). Global investors, seeking to diversify away from the post-bubble heavily-indebted Western world, have inadvertently created a massive “hot-money” bubble in emerging market nations, causing overheated economies and property bubbles everywhere from Brazil to Turkey to the Philippines. Soaring asset prices and easy money is creating “luxury fever” as emerging market nations copy the spendthrift ways that led to the West’s downfall just a few years earlier. In its essence, the emerging markets bubble is a derivative of the commodities and China bubbles and is highly reliant upon the health of those markets.

While emerging market economies, along with commodities markets, have cooled somewhat since the summer of 2011 as China and other emerging market nations tried to engineer a soft-landing in their economies in an effort to fight inflation, there is a very strong possibility that the seeds of the next phase of the emerging markets bubble are being sown at the present moment. As discussed earlier, China as well as the emerging market nations themselves are now embarking on an upturn in its liquidity cycle as its central bank tries to stimulate the economy again. Upturns in China’s liquidity cycle have typically resulted in surges in Chinese asset prices as well as global commodities prices

When U.S. money velocity and credit growth pick up as the economy thaws, commodities prices will rise due to the expansion of the money supply and increased demand for raw materials. The record short position in the euro currency futures markets, as discussed earlier, may be unwound if the benign economic conditions and thawing continues, sending the euro higher and the U.S. dollar lower, boosting commodities prices in the process. Warming and eventually bubbling economies and higher commodities prices will send the global commodities exploration and production boom into overdrive, sparking the acceleration of the bubble booms in natural resource-heavy economies such as Canada, Australia and many emerging market nations. The shale oil and gas boom may be a strong component of a future emerging market resource boom in the future. Natural resource-rich Africa may be the star of the coming emerging market bubble boom abetted by Chinese investment, particularly in the agricultural sector, that is forecast to hit $50 billion by 2015, up 70% from 2009. The continent’s high economic growth rate, with least a dozen countries have expanded by more than 6% a year for six or more years, coupled with pro-growth demographic trends and very low debt-to-GDP ratios may help Africa become a popular investment destination in the next several years.

Massive carry trades, fueled by the trillions of dollars of idle cash, may develop as global capital seeks the high returns offered by emerging market assets. Emerging market equities are a strong candidate for liquidity-driven bubble action in a coming bubble boom as they have only experienced lukewarm action since 2007 and have stayed flat and even declined for the last couple of years, taking a back seat to the booming bond and property markets in their respective countries. After years of underperformance, emerging market equities are now quite undervalued, trading at 10.7 times estimated earnings, compared with 13.2 times for developed-country equities on the MSCI World Index, which is even more impressive considering that emerging market companies have a much higher earnings growth rate than companies in developed nations. In addition, emerging market economies have a higher average GDP growth rate of nearly 7% versus the 2.5% average growth rate of developed economies and lower debt-to-GDP ratios that are around 40% versus the 70% ratios in developed nations such as the United States, the United Kingdom and France.

While BRIC-nation equity markets are currently treading water, the markets of (links contain charts) Mexico, Colombia, Indonesia, Malaysia, Thailand and the Philippines have burst out of the gate strongly in 2012 (a sign of high relative strength), with many breaking above critical technical resistance levels to reach new highs, a good indication of further gains ahead. It is very possible that these aforementioned countries may lead the rest of the emerging equity markets into the next phase of the emerging market stock boom.

If the emerging markets boom develops into a full-blown liquidity-fueled bubble, emerging nations may become a significant market for Western goods, while Western investment banks may reap large profits from their role in IPOs and other capital market activity as well as profits from their emerging market investments, further contributing to the Western “bubblecovery.”

Read more about the Emerging Markets Bubble

The social media bubble has its roots in the relatively recent successes of a leading new wave of tech companies such as Google, Youtube, Apple, Facebook, Groupon, LinkedIn and Twitter. Successful early employees and investors of Google and Facebook have become venture capitalists looking to find and invest in “The Next Facebook.”

The incredible level of hype surrounding social media companies and startups has resulted in truly bubble-like valuations across the entire sector. Facebook’s current market capitalization of $100 billion gives it a very lofty P/E ratio of 100, making it only slightly smaller than blue-chip Cisco’s $114 billion market capitalization, which is justified by $45 billion in annual revenue versus Facebook’s $4.3 billion. LinkedIn carries an incredible 1990s Dot-com bubble-eque P/E ratio of 870, which would require many years of extremely high earnings growth to justify. In another throwback to the Dot-com bubble, many recent social media IPOs are simply money-losing operations with billion-dollar valuations, such as Groupon, Pandora, Yelp and Angie’s List. Profitless social media companies are being rushed to the IPO stage simply to take advantage of the delusional valuations thanks to the current mania for all things social media.

The wild valuations carried by these more well-known social media companies sets the tone for the rest of the sector’s valuations. High valuations like these means that the wealth of social media company founders and investors is largely based on hype and hope rather than on solid economics; they are far wealthier than founders of other businesses that have identical earnings but more realistic valuations. Sky-high social media company valuations provide a powerful incentive for entrepreneurs and venture capitalists to create startups and cash-in big, despite having little or no earnings.

Right now, it seems like everybody and their cousin is trying to launch a social media or an “app” startup and the number of startup incubators has more than tripled since 2009. In addition, venture capital investing has recently hit a ten-year peak thanks to the social media mania. Sean Parker, Napster founder, successful tech VC and early Facebook investor, believes that Silicon Valley is in big bubble trouble due to “too many angel investors throwing way too much money….at aspiring entrepreneurs who aren’t up to the task of building a company.”

The social media bubble has played a strong role in the U.S. economic “bubblecovery” by creating a flurry of business activity and being one of the few reasons for economic optimism (for those who aren’t aware that it is a bubble) in addition to creating nearly half a million jobs since 2007. Outside of the narrow social media sphere, other areas of the technology industry are also engaging in bubble-like behavior and are one of the major engines of job creation since the Great Recession. College students (who are wonderful contrarian indicators!), who were clamoring for Dot-com startup jobs in 2000 and Wall Street jobs in 2007, are now vying for the latest career flavor of the hour: social media and technology (1, 2). Now that social media entrepreneurs are the equivalent of hedge fund managers of the last bubble, Silicon Valley luxury retailers are salivating over the coming surge in business thanks to social media IPOs, especially the Facebook IPO and the one-thousand new millionaires that it will create. Another important way that the social media bubble is contributing to the bubble-based economic recovery is by creating new housing booms in still-bubbly Silicon Valley , New York City and other technology hotspots.

The social media and related-technologies bubble can inflate much further if stocks continue climbing to new heights, creating an even stronger incentive for venture capitalists, bankers and other investors to create bogus social media startups for the purpose of IPOing at ridiculous and immensely lucrative valuations. A successful Facebook IPO will set the tone for the entire social media sector and could be a catalyst for the next wave of social media mania. Many of Facebook’s one-thousand new millionaires may branch out on their own to start or invest in “The Next Facebook,” providing powerful fuel to turn the social media bubble into a true Dot-com bubble 2.0. A portion of the trillions of dollars of corporate cash, including Apple’s $100 billion, will certainly find its way into technology-related investments and buyouts, adding to the frenzy as well. Then factor in the new crowdsourcing capital-raising feature of the American JOBS Act and new VC mega funds, and the technology portion of the coming bubble boom is a practically a done deal.

When unemployed and underemployed people see the new job opportunities created by the social media bubble, many will head back to school for retraining in technological disciplines (only to get the rug pulled out from underneath them again when the tech bubble pops), further reducing the unemployment rate and contributing to the lucrative education and student loan bubble.

Read more about the Social Media Bubble

How the Bubble Boom Will Pop & Cause the Next Depression

A future bubble boom is all but guaranteed due to the commitment of central banks to fight deflation at almost all costs. If the economy stumbles on the road to recovery, such as how the U.S. economy did in the summer of 2010, central banks will simply intervene with more quantitative easing or other forms of monetary stimulus until the recovery finally becomes self-sustaining. Of course, central bank-engineered recoveries are very often “bubblecoveries” in reality as excessive supplies of cheap credit typically finds its way into speculative endeavors and malinvestment rather than sustainable economic development. If a bubble boom materializes, it probably won’t be recognized as a bubble until it is too late (like the U.S. housing bubble), so central banks may let it run its course until their employment goals are achieved, even if it comes at the expense of a somewhat higher than desired inflation rate.

Eventually, the unemployment rate may drop significantly as the bubble boom accelerates into its mania or climax phase, causing central banker worries to shift from unemployment to inflation, overheating and asset bubbles. Central banks will try to fight inflation by raising interest rates and reining in credit, inadvertently popping the “CCC Aches” bubbles (similar to how monetary tightening popped the U.S. housing bubble) that they had inflated in the first place, resulting in a global deflationary meltdown that will far exceed the magnitude of the 2008 Global Finance Crisis. Many central banks will respond to the deflationary “black holes” in their economies with drastic currency devaluations. The popping of the bubble boom will lead to a severe global depression and mass unemployment as post-bubble economies are revealed to be little more than hollowed-out shells at the same time that decades worth of unaddressed economic issues, unable to be masked by false prosperity any longer, simultaneously come home to roost.

(Once again, I must emphasize that this is a theory for now and not yet an outright prediction. The scenario that I’ve discussed is indeed probable and realistic enough to warrant vigilantly monitoring the global economic situation to see if it unfolds according to the framework that I have laid out in this report.)