By Jesse Colombo (This article is frequently updated)

Iceland’s Housing Bubble is a part of the Nordic Housing Bubble, which is a component of the Post-2009 Northern & Western European Housing Bubble.  While the rest of Northern and Western European countries have seen their housing bubbles inflate since 2009 due to "safe haven" investment inflows, Iceland’s Housing Bubble is unique because it has inflated (or reinflated) primarily due to currency controls that were enacted after its epic financial collapse in 2008.

While the rest of Northern and Western European countries have seen their housing bubbles inflate since 2009 due to "safe haven" investment inflows, Iceland’s Housing Bubble is unique because it has inflated (or reinflated) primarily due to currency controls that were enacted after its epic financial collapse in 2008.

Iceland’s Bubble Economy & Crash: Scene One (2000-2008)

From the early-2000s until 2008, Iceland had a booming finance and real estate-based bubble economy (similar to the rest of the world) that helped it to attain the world’s highest living standards in 2007, according to the United Nations. Iceland’s economy was primarily based on the export of fish products and tourism up until the bubble era, when many fishermen became bankers and real estate speculators because those newly-created career opportunities were far more lucrative than fishing. Surging property and stock prices, combined with the strong krona currency, encouraged Icelanders to go on a shopping spree for SUVs, flat-screen televisions and other luxury goods. Iceland’s shopping spree was partly funded by an explosion in household debt, which reached 213% of disposible income and led to inflation. (1)

Icelanders to go on a shopping spree for SUVs, flat-screen televisions and other luxury goods. Iceland’s shopping spree was partly funded by an explosion in household debt, which reached 213% of disposible income and led to inflation. (1)

Iceland’s high interest rates, which attracted incredible amounts of foreign capital (mostly from western Europe) to the country’s high-yielding bank accounts, helped Iceland’s banking sector to grow so rapidly that it soon dwarfed all other industries. Iceland’s biggest bank, Kaupthing Bank, saw its assets balloon thirtyfold from just 208 billion kronur in 2000 to 6.6 trillion kronur in June 2008. By early 2008, Iceland’s three main banks had grown so much that they accounted for three-quarters of the country’s stock market capitalization. Their loans and other assets totaled about 10 times Iceland’s gross domestic product. (2)

When the Global Financial Crisis reared its ugly head in in 2008, Iceland’s economy and banking system was not spared. As global financial markets began to plunge, so did Iceland’s stock and property markets as well as its krona currency. Frozen international credit markets caused foreigners to pull their assets out of Icelandic banks, which soon became unable to roll over their debts. Iceland’s government was eventually forced to partially nationalize Glitnir, the country’s third largest bank, which then caused investors to dump their holdings  of Icelandic sovereign debt and krona due to fears that the country’s massively overleveraged banking sytem would require additional government nationalizations. These fears proved correct when Iceland’s other main banks, Landsbanki and Kaupthing, were nationalized. Soon after, Iceland’s government stunned the world when it refused to bail out its banks with taxpayers’ funds (as the U.S. and many other nations did) and allowed its banks to default on their $85 billion worth of foreign debts. (3) By early 2009, Iceland’s OMX stock index had imploded by 97% from its mid-2007 peak (see chart), while the krona currency (measured against the U.S. dollar) plunged by just over 50% from its mid-2007 peak (see chart).

of Icelandic sovereign debt and krona due to fears that the country’s massively overleveraged banking sytem would require additional government nationalizations. These fears proved correct when Iceland’s other main banks, Landsbanki and Kaupthing, were nationalized. Soon after, Iceland’s government stunned the world when it refused to bail out its banks with taxpayers’ funds (as the U.S. and many other nations did) and allowed its banks to default on their $85 billion worth of foreign debts. (3) By early 2009, Iceland’s OMX stock index had imploded by 97% from its mid-2007 peak (see chart), while the krona currency (measured against the U.S. dollar) plunged by just over 50% from its mid-2007 peak (see chart).

Almost four years after Iceland’s crisis, the country is still hurting and unemployment is quite elevated, but its situation is far more enviable than that of Eurozone "PIIGS" nations such as Spain, Italy and Greece. Iceland’s government is even being praised for letting its banks default on foreign creditors instead of racking-up debt to bail them out as the now heavily-indebted governments of the U.S. and PIIGS nations have done, leading to their ongoing sovereign debt crises. In addition, Iceland’s krona currency (which is far more flexible than the euro) has been allowed to significantly depreciate, creating a revival in the country’s traditional fish exporting and tourism industries. A fisherman, Arnthor Einarsson, recently said, "This is probably one of our best years." (4)

Iceland’s Bubble Trouble: Scene Two (2009-?)

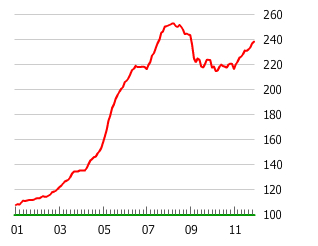

Behind the scenes of Iceland’s much-lauded recovery, however, is an inflating housing bubble that is helping to lend needed strength to the country’s banking system and consumer spending. Iceland’s housing prices rose an incredible 150% from 2001 to 2008 and gently eased 12% during the worst phase of the country’s crisis. A major reason why Iceland’s economy has faired far better than other hard-hit nations is that its property prices have not fallen much, unlike Spain and Ireland, whose property prices have dropped by nearly 30% and 50%, respectively.

In clear defiance of the lessons taught by the Global Financial Crisis, the price of new homes in Iceland have hit a record in the first quarter of 2012, having surged 40.1 percent since the final three months of 2010, according to estimates by the National Registry of Iceland in Reykjavik. Average house prices have risen 11.3 percent since the market bottomed at the end of 2009, according to central bank data at the end of the first quarter. (3) Iceland’s housing prices are rising in tandem with the overall Nordic Housing Bubble and are exacerbated by currency controls that are designed to prevent capital from flowing out of the country until 2015. Nearly 8 billion kronur  ($1.13 billion as of June 28, 2012) is held within Iceland by foreign investors, unable to leave the country, and is flowing (along with domestic capital) straight into Iceland’s property markets. According to Asgeir Jonsson, an economist at Reykjavik-based asset manager Gamma, “If the development continues without interference, this will lead to a property bubble within the next two years” and “There’s a greater risk of an asset bubble being created in an economy that is closed off behind capital controls.” (3) Iceland’s housing market is quite overvalued, with an average apartment selling for 6.36 times the country’s average income, according to Statistics Iceland. Finnur Eiriksson, a computer scientist living in Reykjavik, said, “The exorbitant prices in the housing market, so early after the collapse of the Icelandic economy, are quite shocking.” (3)

($1.13 billion as of June 28, 2012) is held within Iceland by foreign investors, unable to leave the country, and is flowing (along with domestic capital) straight into Iceland’s property markets. According to Asgeir Jonsson, an economist at Reykjavik-based asset manager Gamma, “If the development continues without interference, this will lead to a property bubble within the next two years” and “There’s a greater risk of an asset bubble being created in an economy that is closed off behind capital controls.” (3) Iceland’s housing market is quite overvalued, with an average apartment selling for 6.36 times the country’s average income, according to Statistics Iceland. Finnur Eiriksson, a computer scientist living in Reykjavik, said, “The exorbitant prices in the housing market, so early after the collapse of the Icelandic economy, are quite shocking.” (3)

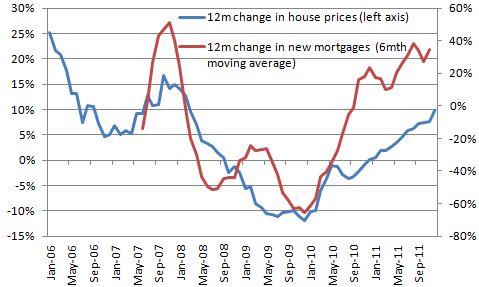

The recent rise in Icelandic housing prices is fueled by a new mortgage boom that is growing at a nearly 40% rate, which is almost the same rate that the country’s mortgage market was growing at the peak of the prior bubble in 2007:

Chart Source: Icelandic Economics

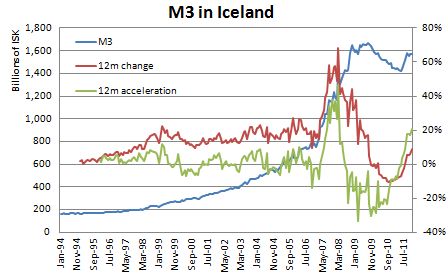

Now that borrowing money is in vogue in Iceland again, their M3 Money Supply growth rate has strongly accelerated and is now growing at the same rate as it was in the mid-1990s:

Surging housing prices are helping to drive Iceland’s consumer spending higher, which was identified by a team of economists at Arion Bank as the main reason for the country’s economic recovery. (3) Iceland’s economy is slated to grow by 2.6% in 2012, which is even faster than Sweden’s economic growth rate. Car sales doubled in the first quarter of 2012 as Iceland’s consumers rekindled their love affair with shopping again. Jon Olafsson, who owns a car dealership in Reykjavik, expects to sell almost 1,000 cars this year, having sold less than 100 cars in 2009. (4) Of course, in this day and age,  surging consumer spending and household debt levels go hand-in-hand and Iceland doesn’t disappoint in this regard as household debt grew to 270% of disposable income in 2010, up from 217% in 2007 and about 50% in the 1980s. (3)

surging consumer spending and household debt levels go hand-in-hand and Iceland doesn’t disappoint in this regard as household debt grew to 270% of disposable income in 2010, up from 217% in 2007 and about 50% in the 1980s. (3)

Iceland is clearly experiencing some stage of a housing bubble, which is more proof that the world has learned very little from the Global Financial Crisis and is therefore doomed to repeat it, though likely on a far more devastating scale. The Icelandic Housing Bubble is likely to pop when the overall Nordic Housing Bubble pops and exposes these nations as the false safe havens that they truly are.

Icelandic Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: