By Jesse Colombo (This article is frequently updated)

The Nordic Housing Bubble or Scandinavian Housing Bubble is a little-known housing bubble that has inflated during the past decade in Norway, Sweden, Finland, Denmark and Iceland and is a part of the Post-2009 Northern and Western European Housing Bubble, which is a part of the Post-2009 Global Housing Bubble. The Nordic Housing Bubble formed at the same time, and for similar reasons, as  the calamitous housing bubbles in the U.S. and European PIIGS nations, but has continued to expand since 2009 due to "safe haven" investment inflows and loose monetary conditions. Surging property prices and credit growth has created a convincing façade that most people see as a "Nordic Economic Miracle," instead of the classic bubble economies that they have truly become. When the Nordic Housing Bubble pops, formerly high-flying countries like Norway and Finland will have more in common with Spain and Italy than they ever imagined was possible.

the calamitous housing bubbles in the U.S. and European PIIGS nations, but has continued to expand since 2009 due to "safe haven" investment inflows and loose monetary conditions. Surging property prices and credit growth has created a convincing façade that most people see as a "Nordic Economic Miracle," instead of the classic bubble economies that they have truly become. When the Nordic Housing Bubble pops, formerly high-flying countries like Norway and Finland will have more in common with Spain and Italy than they ever imagined was possible.

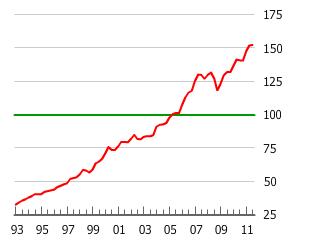

Chart Source: GlobalPropertyGuide.com

Norwegian property prices have tripled since the mid-1990s, up nearly 30% since the Great Recession as the oil-rich nation rode the coattails of the commodities bubble and has benefited from the same “flight to safety” capital flows that have benefited (and inflated bubbles in) other Nordic countries. Norwegian property prices are highly overvalued, currently valued at 125% of their historic price-to-income ratio and an incredible 170% of their historic price-to-rent ratio. [1] Norway’s Prime Minister Jens Stoltenberg admitted that he was “afraid” that the Norwegian property bubble might burst [2], while renowned U.S. bubble skeptic Robert Shiller said of Norwegian property prices, “This really does look like a bubble.” [3] and that policy makers “should start worrying now because when the home prices get so high there’s a problem.” The euro area’s crisis has sparked “flight to safety” capital flows into Norway’s highly-desirable investment assets, pushing the Krone currency to undesirable export-harming heights and forcing the country’s central bank to cut interest rates to stem the inflow. Norway’s ballooning housing bubble is a  side-effect of the nation’s excessively low interest rates relative to economic growth and inflation rates.

side-effect of the nation’s excessively low interest rates relative to economic growth and inflation rates.

In February 2012, the IMF cut Norway’s growth forecast, saying that the Norwegian housing bubble is the country’s biggest economic risk and threatens everything from banks to economic growth. [4] Norway’s booming housing markets and cheap interest rates are encouraging households to engage in a typical bubble-style debt binge as private debt burdens are estimated to grow to about 204 percent of disposable incomes in 2012. [5] A major risk to Norway’s economy (and possible bubble-popping catalyst) that virtually no mainstream commentators have acknowledged is the very real possibility that oil prices might drop and sharply reduce the country’s oil profits and thus economic growth.

Norwegian Housing Bubble Articles List

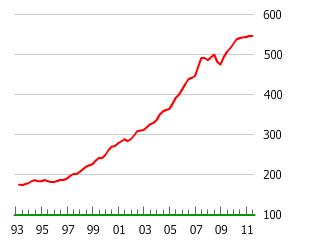

In a pattern similar to other Nordic property markets, Swedish property prices have nearly tripled since the mid-1990s and shrugged off the Great Recession woes to rise to incredible new heights. Swedish property prices are overvalued, currently valued at 120% of their historic price-to-income ratio and 140% of their historic price-to-rent ratio. [1] The most recent phase of Sweden’s housing bubble is fueled by mortgage interest rates that have fallen from 6% in August 2008 to a just above 3%, with adjustable rate mortgages falling to under 2%. [2] Tommy Waidelich, the Social Democrats’ economy spokesman, warned that Sweden may have a housing bubble and that “A drop in house prices would hit growth, employment and state finances” and also saying, “If

the reason that the price is high today is only because investors believe that the selling price will be high tomorrow – when “fundamental” factors do not seem to justify such a price – then a bubble exists.” [3]

the reason that the price is high today is only because investors believe that the selling price will be high tomorrow – when “fundamental” factors do not seem to justify such a price – then a bubble exists.” [3]

The IMF has also warned of a possible Swedish housing bubble, saying “There is significant risk of a decline in house prices in coming years, even in a relatively benign economic scenario,” [4] while the OECD warned that Swedish housing prices are overvalued by about 30 percent in relation to income. [5] Robert Shiller, the economist who successfully predicted the popping of the Dot-com and U.S. housing bubbles, warned investors against treating Sweden and Norway’s markets as safe-havens as the Nordic region is caught up in asset bubbles that will end with plunging asset prices. [6] A Danish finance minister has even warned Sweden of the risks of its housing bubble, saying, “Do not make the same mistake as we did in Denmark,” [7] referring to the Danish property bubble that has been deflating since 2008.

Swedish Housing Bubble Articles List

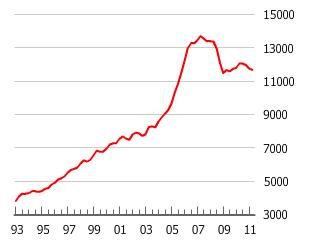

Finnish property prices soared a dizzying 250% from the mid-1990s to 2008 [1], dipped slightly in the 2009 recession and bolted 20% higher as Finland and other Nordic countries recovered from the recession faster than their European

neighbors to the south. The Finnish property bubble is being fueled by a mortgage market in which a jaw-dropping 90% of loans are of the highly dangerous adjustable rate variety, while banks are taking a page straight out of the U.S. housing bubble as they push reverse mortgages on their elderly customers. A Finnish bank advertisement for reverse mortgages even shows a cartoon person taking a vacation paid for with cash withdrawn from an ATM that is attached to their house! [See cartoon] It is as if nobody has learned a thing from the U.S. housing bubble – the saying, “those who don’t learn from history are doomed to repeat it” could not apply to a better scenario than the Finnish housing bubble.

neighbors to the south. The Finnish property bubble is being fueled by a mortgage market in which a jaw-dropping 90% of loans are of the highly dangerous adjustable rate variety, while banks are taking a page straight out of the U.S. housing bubble as they push reverse mortgages on their elderly customers. A Finnish bank advertisement for reverse mortgages even shows a cartoon person taking a vacation paid for with cash withdrawn from an ATM that is attached to their house! [See cartoon] It is as if nobody has learned a thing from the U.S. housing bubble – the saying, “those who don’t learn from history are doomed to repeat it” could not apply to a better scenario than the Finnish housing bubble.

Finnish Housing Bubble Articles List

Although Danish housing prices have leveled-off after doubling from the late 1990s to 2008, prices are still thoroughly in nosebleed territory and are among the most overvalued in the entire world. Jes Asmussen, chief economist at Svenska Handelsbanken AB, claims that

Denmark’s housing market may still be as much as 25 percent overvalued. [1] Denmark’s overleveraged banking system, with banking assets as a percentage of GDP at 454% versus the U.S.’s 90%, will experience unimaginable pain when the country’s housing bubble deflates in earnest. For all of the worry that Greece’s $462 billion sovereign debt has caused the world, Denmark’s ticking-time-bomb mortgage market alone is worth more than $500 billion, with nearly 70% of new mortgages being of the highly-risky adjustable rate variety (ARMs). [2]

Denmark’s housing market may still be as much as 25 percent overvalued. [1] Denmark’s overleveraged banking system, with banking assets as a percentage of GDP at 454% versus the U.S.’s 90%, will experience unimaginable pain when the country’s housing bubble deflates in earnest. For all of the worry that Greece’s $462 billion sovereign debt has caused the world, Denmark’s ticking-time-bomb mortgage market alone is worth more than $500 billion, with nearly 70% of new mortgages being of the highly-risky adjustable rate variety (ARMs). [2]

Danish Housing Bubble Articles List

Iceland’s Housing Bubble

(Click here to read a more extensive article about Iceland’s Housing Bubble)

While other Northern and Western European countries have seen their housing bubbles inflate since 2009 due to "safe haven" investment inflows, Iceland’s Housing Bubble is unique because it has inflated (or reinflated) primarily due to currency controls that were enacted after its epic financial collapse in 2008.

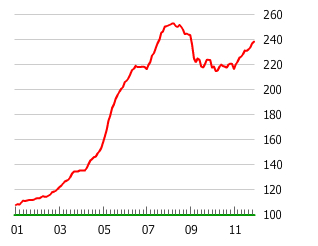

Though Iceland is said to be recovering very well from its financial crisis, there is an inflating housing bubble that is lurking behind the scenes that is helping to lend much-needed strength to the country’s banking system and consumer spending. Iceland’s housing prices rose an incredible 150% from 2001 to 2008 and gently eased 12% during the worst phase of the country’s crisis. A major reason why Iceland’s economy has faired far better than other hard-hit nations is that its property prices have not fallen much, unlike Spain and Ireland, whose property prices have dropped by nearly 30% and 50%, respectively.

In clear defiance of the lessons taught by the Global Financial Crisis, the price of new homes in Iceland have hit a record in the first quarter of 2012, having surged 40.1 percent since the final three months of 2010, according to estimates by the National Registry of Iceland in Reykjavik. Average house prices have risen 11.3 percent since the market bottomed at the end of 2009, according to central bank data at the end of the first quarter. (3) Iceland’s housing prices are rising in tandem with the overall Nordic Housing Bubble and are exacerbated by currency controls that are designed to prevent capital from flowing out of the country until 2015. Nearly 8 billion kronur  ($1.13 billion as of June 28, 2012) is held within Iceland by foreign investors, unable to leave the country, and is flowing (along with domestic capital) straight into Iceland’s property markets. According to Asgeir Jonsson, an economist at Reykjavik-based asset manager Gamma, “If the development continues without interference, this will lead to a property bubble within the next two years” and “There’s a greater risk of an asset bubble being created in an economy that is closed off behind capital controls.” (3) Iceland’s housing market is quite overvalued, with an average apartment selling for 6.36 times the country’s average income, according to Statistics Iceland. Finnur Eiriksson, a computer scientist living in Reykjavik, said, “The exorbitant prices in the housing market, so early after the collapse of the Icelandic economy, are quite shocking.” (3)

($1.13 billion as of June 28, 2012) is held within Iceland by foreign investors, unable to leave the country, and is flowing (along with domestic capital) straight into Iceland’s property markets. According to Asgeir Jonsson, an economist at Reykjavik-based asset manager Gamma, “If the development continues without interference, this will lead to a property bubble within the next two years” and “There’s a greater risk of an asset bubble being created in an economy that is closed off behind capital controls.” (3) Iceland’s housing market is quite overvalued, with an average apartment selling for 6.36 times the country’s average income, according to Statistics Iceland. Finnur Eiriksson, a computer scientist living in Reykjavik, said, “The exorbitant prices in the housing market, so early after the collapse of the Icelandic economy, are quite shocking.” (3)

Surging housing prices are helping to drive Iceland’s consumer spending higher, which was identified by a team of economists at Arion Bank as the main reason for the country’s economic recovery. (3) Iceland’s economy is slated to grow by 2.6% in 2012, which is even faster than Sweden’s economic growth rate. Car sales doubled in the first quarter of 2012 as Iceland’s consumers rekindled their love affair with shopping again. Jon Olafsson, who owns a car dealership in Reykjavik, expects to sell almost 1,000 cars this year, having sold less than 100 cars in 2009. (4) Of course, in this day and age,  surging consumer spending and household debt levels go hand-in-hand and Iceland doesn’t disappoint in this regard as household debt grew to 270% of disposable income in 2010, up from 217% in 2007 and about 50% in the 1980s. (3)

surging consumer spending and household debt levels go hand-in-hand and Iceland doesn’t disappoint in this regard as household debt grew to 270% of disposable income in 2010, up from 217% in 2007 and about 50% in the 1980s. (3)

Iceland is clearly experiencing some stage of a housing bubble, which is more proof that the world has learned very little from the Global Financial Crisis and is therefore doomed to repeat it, though likely on a far more devastating scale. The Icelandic Housing Bubble is likely to pop when the overall Nordic Housing Bubble pops and exposes these nations as the false safe havens that they truly are.

Icelandic Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: