By Jesse Colombo (This article is frequently updated)

The Dutch housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

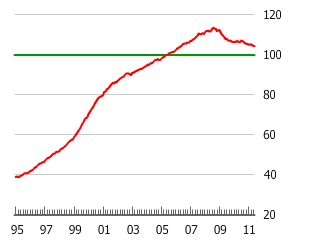

Chart Source: GlobalPropertyGuide.com

While Dutch housing prices have moderately deflated since 2008 after doubling since the late 1990s, they are still firmly in bubble-territory, according to a report by The Economist magazine. The Netherlands’ property market ranks among the most overvalued property markets in the world, overvalued by over 25% according to price-to-income ratio and price-to-rent ratios, common property-market valuation measures. [1] Like many countries in recent decades, the Netherlands engaged in a mortgage-borrowing binge that sent property prices soaring, saddling Dutch households with a level of household debt that exceeds 240% of disposable income, the highest level in the euro zone by far. [2]

Dutch Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: