This analysis has been creating quite a stir in the past year and was featured in the popular ZeroHedge blog, Business Insider, and in the Keiser Report (starts at 1:40):

Could Sweden or Finland be the scene of the next European financial crisis? It is actually far likelier than most people realize. While the world has been laser-focused on the woes of the heavily-indebted PIIGS nations for the last couple of years, property markets in Northern and Western European countries have been bubbling up to dizzying new heights in a repeat performance of the very property bubbles that caused the global financial crisis in the first place. Nordic and Western European countries such as Norway and Switzerland have attracted strong investment inflows due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008. With their overheated economies and ballooning property bubbles, today’s safe-haven European countries may very well be tomorrow’s Greeces and Italys.

countries such as Norway and Switzerland have attracted strong investment inflows due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008. With their overheated economies and ballooning property bubbles, today’s safe-haven European countries may very well be tomorrow’s Greeces and Italys.

I’ve named this massive multi-country housing bubble “The Post-2009 Northern and Western European Housing Bubble.”

(The Post-2009 Northern and Western European Housing Bubble is a part of the overall Post-2009 Global Housing Bubble or “Housing Bubble 2.0” that I’ve identified. )

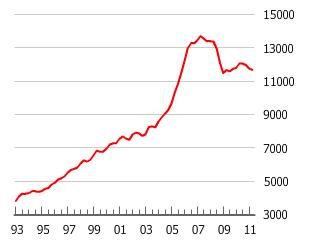

Chart Source: GlobalPropertyGuide.com

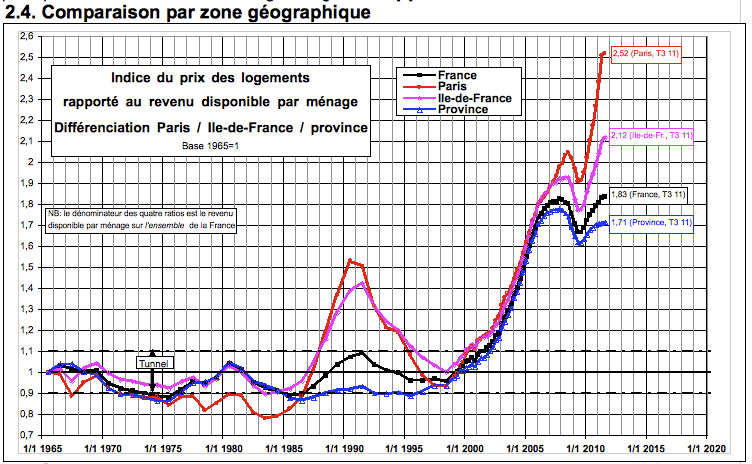

Like Paris, the city of London has such a strong level of international “brand recognition” and a perceived safe-haven status that wealthy foreign investors are clamoring to buy property in prime areas such as central London. “London property is the ‘Swiss bank account’ of the 21st century,” says Robin Hardy, an analyst at London investment firm Peel Hunt. Rich people in places like Egypt, Syria and southern Europe are rushing to get their money away from the turmoil, and for want of a better alternative, they are plunking it down in the “millionaire’s playground” of central London. [4] The nouveau riche of China, India and other emerging markets are also keen on diversifying their wealth into prime Western property markets such as London, Vancouver and Manhattan, while one hedge-fund manager said that London property was a “laundromat for Russian money.” An entire generation is locked out of the city’s broken and outrageously-bubbled housing markets as the average Londoner would need to triple their salary to £87,000 to buy an average price property. [5] The prime London property bubble is highly vulnerable to the popping of the precariously-teetering China and emerging markets bubbles as well as job losses and decreasing bonuses for City of London financial workers. [6]

Like Paris, the city of London has such a strong level of international “brand recognition” and a perceived safe-haven status that wealthy foreign investors are clamoring to buy property in prime areas such as central London. “London property is the ‘Swiss bank account’ of the 21st century,” says Robin Hardy, an analyst at London investment firm Peel Hunt. Rich people in places like Egypt, Syria and southern Europe are rushing to get their money away from the turmoil, and for want of a better alternative, they are plunking it down in the “millionaire’s playground” of central London. [4] The nouveau riche of China, India and other emerging markets are also keen on diversifying their wealth into prime Western property markets such as London, Vancouver and Manhattan, while one hedge-fund manager said that London property was a “laundromat for Russian money.” An entire generation is locked out of the city’s broken and outrageously-bubbled housing markets as the average Londoner would need to triple their salary to £87,000 to buy an average price property. [5] The prime London property bubble is highly vulnerable to the popping of the precariously-teetering China and emerging markets bubbles as well as job losses and decreasing bonuses for City of London financial workers. [6]

UK and London Housing Bubble Articles List

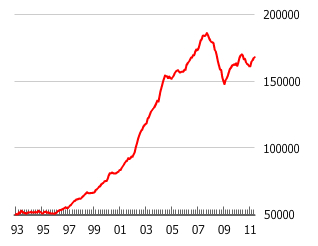

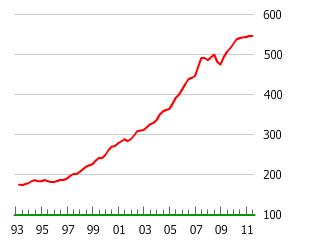

Chart Source: Bulle-Immobiliere.org

property prices, causing fixed-rate mortgage lending to increase by 73% by early 2011. [3]

property prices, causing fixed-rate mortgage lending to increase by 73% by early 2011. [3]

The French property market now has the dubious distinction of being the most overvalued in Europe and the third most overvalued market in the world, behind only Hong Kong and Australia [4], which have property bubbles of their own. The Paris-based OECD warned that “there is a risk that a prolonged period of easy finance could result in a price bubble,” which may endanger French banks [5], while Hervé Boulhol, the OECD’s France economist, warned against treating French real estate as a safe-haven and that the property market’s powerful rise without a corresponding rise in income “may signal a bubble phenomenon, as a bubble is a disconnection with fundamentals.” [6] Moody’s also issued a warning that the French property market was overheating and that the least cautious lenders could face steep losses in a more price severe drop. [7] By October 2012, the French property boom showed signs of an abrupt slowdown, with new mortgage loans dropping 45.8% (yoy) and a 30 to 40% decrease in home sales in Paris and Ile-de-France. [8]

French Housing Bubble Articles List

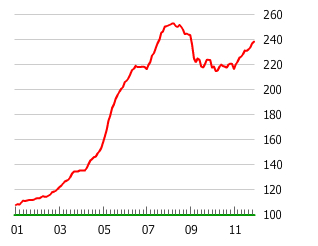

Chart Source: blogs.ft.com

Chart Source: blogs.ft.com

While Germany was fortunate and sensible enough to have avoided engaging in the 2000s housing bubble folly with the rest of the world, Germans certainly seem eager to make up for lost time. The European Central Bank’s ultra-low key interest rate, while appropriate for the ailing PIIGS nations, is too low for faster-growing Germany resulting in negative real interest rates and fears of inflation. As is common in countries with negative real interest rates, German investors are pulling money out of low-yielding bank accounts and investments and plowing it into all types of real estate, causing prices to boom for the first time in a very long while. Property prices in Munich and Hamburg rose by more than 10% in 2011 [1] , while obscure fields and forests in northeastern Germany’s Uckermark region have soared by as much as 20 to 30 percent. [2] In September 2012, George Soros said “You have a serious danger of a housing bubble developing in Berlin. It has a lot to do with the flight of capital and negative real interest rates.” [3] It is too early to determine if Germany is in the midst of a property bubble, but it is certainly a situation that warrants monitoring, especially if there is a temporary improvement in global economic growth and sentiment.

German Housing Bubble Articles List

Chart Source: GlobalPropertyGuide.com

creating alarmingly similar monetary conditions to those that caused Switzerland’s 1980s property bubble. [2]

creating alarmingly similar monetary conditions to those that caused Switzerland’s 1980s property bubble. [2]

In response to rising Swiss real estate prices, UBS launched a Swiss real estate bubble index, which surpassed a two-decade high in the 3rd quarter, officially placing Swiss property in the index’s “risk zone.” [3] Swiss National Bank Chairman Philipp Hildebrand warned that, “A rise in real-estate prices is among the greatest threats to Switzerland’s economy.” [4] Most worrisome is the warning of Janwillem Acket, chief economist for Julius Baer Group Ltd. (BAER), who claims that Switzerland could experience its own version of the subprime borrowing crisis, saying, “People who shouldn’t be borrowing are now seriously considering entering the housing market.” [5]

Swiss Housing Bubble Articles List

Chart Source: GlobalPropertyGuide.com

Belgian Housing Bubble Articles List

Chart Source: GlobalPropertyGuide.com

Dutch Housing Bubble Articles List

Chart Source: GlobalPropertyGuide.com

Luxembourg Housing Bubble Articles List

Chart Source: GlobalPropertyGuide.com

Chart Source: GlobalPropertyGuide.comAustrian Housing Bubble Articles List

The Nordic Housing Bubble:

Chart Source: GlobalPropertyGuide.com

Danish Housing Bubble Articles List

Chart Source: GlobalPropertyGuide.com

the reason that the price is high today is only because investors believe that the selling price will be high tomorrow – when ”fundamental” factors do not seem to justify such a price – then a bubble exists.” [3]

the reason that the price is high today is only because investors believe that the selling price will be high tomorrow – when ”fundamental” factors do not seem to justify such a price – then a bubble exists.” [3]

The IMF has also warned of a possible Swedish housing bubble, saying “There is significant risk of a decline in house prices in coming years, even in a relatively benign economic scenario,” [4] while the OECD warned that Swedish housing prices are overvalued by about 30 percent in relation to income. [5] Robert Shiller, the economist who successfully predicted the popping of the Dot-com and U.S. housing bubbles, warned investors against treating Sweden and Norway’s markets as safe-havens as the Nordic region is caught up in asset bubbles that will end with plunging asset prices. [6] A Danish finance minister has even warned Sweden of the risks of its housing bubble, saying, “Do not make the same mistake as we did in Denmark,” [7] referring to the Danish property bubble that has been deflating since 2008.

Swedish Housing Bubble Articles List

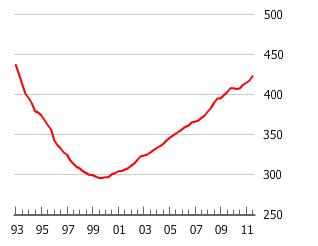

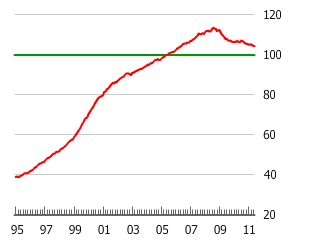

Chart Source: Federal Reserve Bank of San Francisco

Chart Source: Federal Reserve Bank of San Francisco(Note: Housing prices are inflation-adjusted and indexed to 100 from their 1985 levels)

of the nation’s excessively low interest rates relative to economic growth and inflation rates.

of the nation’s excessively low interest rates relative to economic growth and inflation rates.

In February 2012, the IMF cut Norway’s growth forecast, saying that the Norwegian housing bubble is the country’s biggest economic risk and threatens everything from banks to economic growth. [4] In June 2012, the U.S. Federal Reserve warned that Norway’s property market was experiencing a bubble. [5] Norway’s booming housing markets and cheap interest rates are encouraging households to engage in a typical bubble-style debt binge as private debt burdens are estimated to grow to about 204 percent of disposable incomes in 2012. [6] A major risk to Norway’s economy (and possible bubble-popping catalyst) that virtually no mainstream commentators have acknowledged is the very real possibility that oil prices might drop and sharply reduce the country’s oil profits and thus economic growth.

Norwegian Housing Bubble Articles List

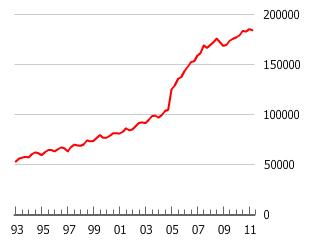

Chart Source: GlobalPropertyGuide.com

neighbors to the south. The Finnish property bubble is being fueled by a mortgage market in which a jaw-dropping 90% of loans are of the highly dangerous adjustable rate variety, while banks are taking a page straight out of the U.S. housing bubble as they push reverse mortgages on their elderly customers. A Finnish bank advertisement for reverse mortgages even shows a cartoon person taking a vacation paid for with cash withdrawn from an ATM that is attached to their house! [See cartoon] It is as if nobody has learned a thing from the U.S. housing bubble – the saying, “those who don’t learn from history are doomed to repeat it” could not apply to a better scenario than the Finnish housing bubble.

neighbors to the south. The Finnish property bubble is being fueled by a mortgage market in which a jaw-dropping 90% of loans are of the highly dangerous adjustable rate variety, while banks are taking a page straight out of the U.S. housing bubble as they push reverse mortgages on their elderly customers. A Finnish bank advertisement for reverse mortgages even shows a cartoon person taking a vacation paid for with cash withdrawn from an ATM that is attached to their house! [See cartoon] It is as if nobody has learned a thing from the U.S. housing bubble – the saying, “those who don’t learn from history are doomed to repeat it” could not apply to a better scenario than the Finnish housing bubble.

Finnish Housing Bubble Articles List

Iceland’s Housing Bubble

Though Iceland is said to be recovering very well from its financial crisis, there is an inflating housing bubble that is lurking behind the scenes that is helping to lend much-needed strength to the country’s banking system and consumer spending. Iceland’s housing prices rose an incredible 150% from 2001 to 2008 and gently eased 12% during the worst phase of the country’s crisis. A major reason why Iceland’s economy has faired far better than other hard-hit nations is that its property prices have not fallen much, unlike Spain and Ireland, whose property prices have dropped by nearly 30% and 50%, respectively.

In clear defiance of the lessons taught by the Global Financial Crisis, the price of new homes in Iceland have hit a record in the first quarter of 2012, having surged 40.1 percent since the final three months of 2010, according to estimates by the National Registry of Iceland in Reykjavik. Average house prices have risen 11.3 percent since the market bottomed at the end of 2009, according to central bank data at the end of the first quarter. (3) Iceland’s housing prices are rising in tandem with the overall Nordic Housing Bubble and are exacerbated by currency controls that are designed to prevent capital from flowing out of the country until 2015. Nearly 8 billion kronur  ($1.13 billion as of June 28, 2012) is held within Iceland by foreign investors, unable to leave the country, and is flowing (along with domestic capital) straight into Iceland’s property markets. According to Asgeir Jonsson, an economist at Reykjavik-based asset manager Gamma, “If the development continues without interference, this will lead to a property bubble within the next two years” and “There’s a greater risk of an asset bubble being created in an economy that is closed off behind capital controls.” (3) Iceland’s housing market is quite overvalued, with an average apartment selling for 6.36 times the country’s average income, according to Statistics Iceland. Finnur Eiriksson, a computer scientist living in Reykjavik, said, “The exorbitant prices in the housing market, so early after the collapse of the Icelandic economy, are quite shocking.” (3)

($1.13 billion as of June 28, 2012) is held within Iceland by foreign investors, unable to leave the country, and is flowing (along with domestic capital) straight into Iceland’s property markets. According to Asgeir Jonsson, an economist at Reykjavik-based asset manager Gamma, “If the development continues without interference, this will lead to a property bubble within the next two years” and “There’s a greater risk of an asset bubble being created in an economy that is closed off behind capital controls.” (3) Iceland’s housing market is quite overvalued, with an average apartment selling for 6.36 times the country’s average income, according to Statistics Iceland. Finnur Eiriksson, a computer scientist living in Reykjavik, said, “The exorbitant prices in the housing market, so early after the collapse of the Icelandic economy, are quite shocking.” (3)

Surging housing prices are helping to drive Iceland’s consumer spending higher, which was identified by a team of economists at Arion Bank as the main reason for the country’s economic recovery. (3) Iceland’s economy is slated to grow by 2.6% in 2012, which is even faster than Sweden’s economic growth rate. Car sales doubled in the first quarter of 2012 as Iceland’s consumers rekindled their love affair with shopping again. Jon Olafsson, who owns a car dealership in Reykjavik, expects to sell almost 1,000 cars this year, having sold less than 100 cars in 2009. (4) Of course, in this day and age, surging consumer spending and household debt levels go hand-in-hand and Iceland doesn’t disappoint in this regard as household debt grew to 270% of disposable income in 2010, up from 217% in 2007 and about 50% in the 1980s. (3)

Icelandic Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: