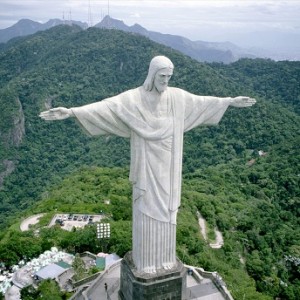

Encouraged by the rise of China and India in the past decade, investors and economic commentators have eagerly looked toward other emerging market nations in hopes of finding "The Next China" – or at least the next country to supply the raw materials that China needs for its construction-driven growth boom and bubble (which entails the building of empty cities to create economic growth). Furthermore, since the 2008 Global Financial Crisis, investors have sought to invest in emerging markets as a way of diversifying away from investments in the heavily-indebted and slow-growing American and European economies. Unfortunately, the vast ocean of "hot money" that has poured into emerging markets has created a massive economic bubble throughout nearly the entire emerging world, including overheating economies and property bubbles everywhere from Brazil to Indonesia to Turkey. Ballooning asset prices and easy money has led to "luxury fever" as emerging market nations copy the spendthrift ways that contributed to the West’s downfall just a few years earlier. The Emerging Markets Bubble is a derivative of the bubbles in China and commodities and will pop when they inevitably do.

Encouraged by the rise of China and India in the past decade, investors and economic commentators have eagerly looked toward other emerging market nations in hopes of finding "The Next China" – or at least the next country to supply the raw materials that China needs for its construction-driven growth boom and bubble (which entails the building of empty cities to create economic growth). Furthermore, since the 2008 Global Financial Crisis, investors have sought to invest in emerging markets as a way of diversifying away from investments in the heavily-indebted and slow-growing American and European economies. Unfortunately, the vast ocean of "hot money" that has poured into emerging markets has created a massive economic bubble throughout nearly the entire emerging world, including overheating economies and property bubbles everywhere from Brazil to Indonesia to Turkey. Ballooning asset prices and easy money has led to "luxury fever" as emerging market nations copy the spendthrift ways that contributed to the West’s downfall just a few years earlier. The Emerging Markets Bubble is a derivative of the bubbles in China and commodities and will pop when they inevitably do.

Please follow my Twitter feed for commentary and news about the emerging markets bubble:

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: