By Jesse Colombo (This article is frequently updated)

Austria’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

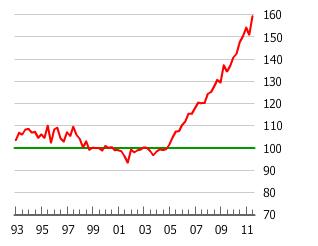

Chart Source: GlobalPropertyGuide.com

Austria’s housing prices are up a stout 60% since 2005, a rise completely unabated by the global financial crisis. Negative real interest rates and a relatively-low unemployment rate of 4.9% have encouraged Austrians to close low-yielding checking accounts and park their life savings in local property for rental income and capital gains. [1] Austria’s obvious property bubble poses serious risks to the country’s banks, which are already teetering on the brink after losing billions of euros in an Eastern European mortgage-lending scheme that has gone terribly awry since 2008. [2]

Austrian Housing Bubble Articles List

Questions? Comments?

Click on the buttons below to discuss or ask me any question about these bubbles on Twitter or Facebook and I will personally respond: